Press & Media

Your contact:

Anita Reuter · presse@banksapi.de

Our press releases

Stadtsparkasse Wuppertal adopts Open-Banking solution from BANKSapi

02.12.2024

Until now, the service www.treuewelt-wuppertal.de was only accessible to customers of Stadtsparkasse Wuppertal – but this is changing. With the help of BANKSapi, users can now link accounts from external banks. This allows all residents of Wuppertal to benefit from local shopping offers and other benefits.

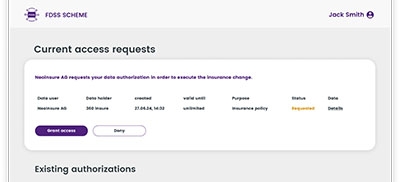

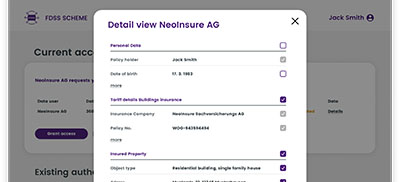

BANKSapi is the first to propose a concept for the FIDA Financial Data Sharing Scheme

18.07.2024

The open banking and open finance specialist BANKSapi Technology GmbH has developed an implementation proposal for the creation of a system for the exchange of financial data (according to the EU Commission’s draft FIDA regulation) and published it as a white paper.

BANKSapi expands management with EX-W&W manager

24.06.2024

Manuel Wanner-Behr (38) joins the management of Munich-based open banking and open finance specialist BANKSapi Technology GmbH as Co-CEO with immediate effect.