BANKSapi: The Open Banking and Open Finance Platform:

- Access to bank accounts & custody accounts

- Data on financial products & PayPal

- SEPA Payments

- Smart data analytics in real time

- Micro frontends through to apps & portals

BANKSapi is known from

Our Products

Open Banking

BANKS/Connect – One API, all banks: Access to over 3,000 banks, cards and securities accounts – with just a few lines of code. Real-time data for millions of accounts and SEPA payments. A single API for personal and business accounts – PSD2 and GDPR compliant and highly scalable.

Learn morePay by Bank

PAY/Connect – Direct, fast, cost-efficient: Payments directly from account to account in real time. Unbeatably low costs, as there are no intermediaries. Pay by Bank is the alternative to credit cards or payment on invoice. For online shops or POS.

Learn moreData Analytics

AI/Connect – Make account data work for you: Uncover sales potential, risks, and insights in real time. Our AI-driven analytics transform transaction data into actionable knowledge – ideal for new use cases and business models.

Learn moreBanking Widgets

WEB/Connect – Banking widgets for your app: Easily enhance your app or website with plug-and-play banking and analytics widgets. Fully customizable, framework-agnostic, and ready to use – for a seamless user experience.

Learn moreFrontend Solutions

HUMAN/Connect – Your finance platform: Build your own financial apps or customer portals fast and cost-effectively. Launch Financial Homes, analytics dashboards or user interfaces – ready for production with minimal effort.

Learn morePSD2 License

REG/Protect – Compliance-as-a-Service: Stay PSD2-compliant without the license burden. We handle all regulatory requirements while you grow your business. License-as-a-Service, built for secure, scalable fintech solutions.

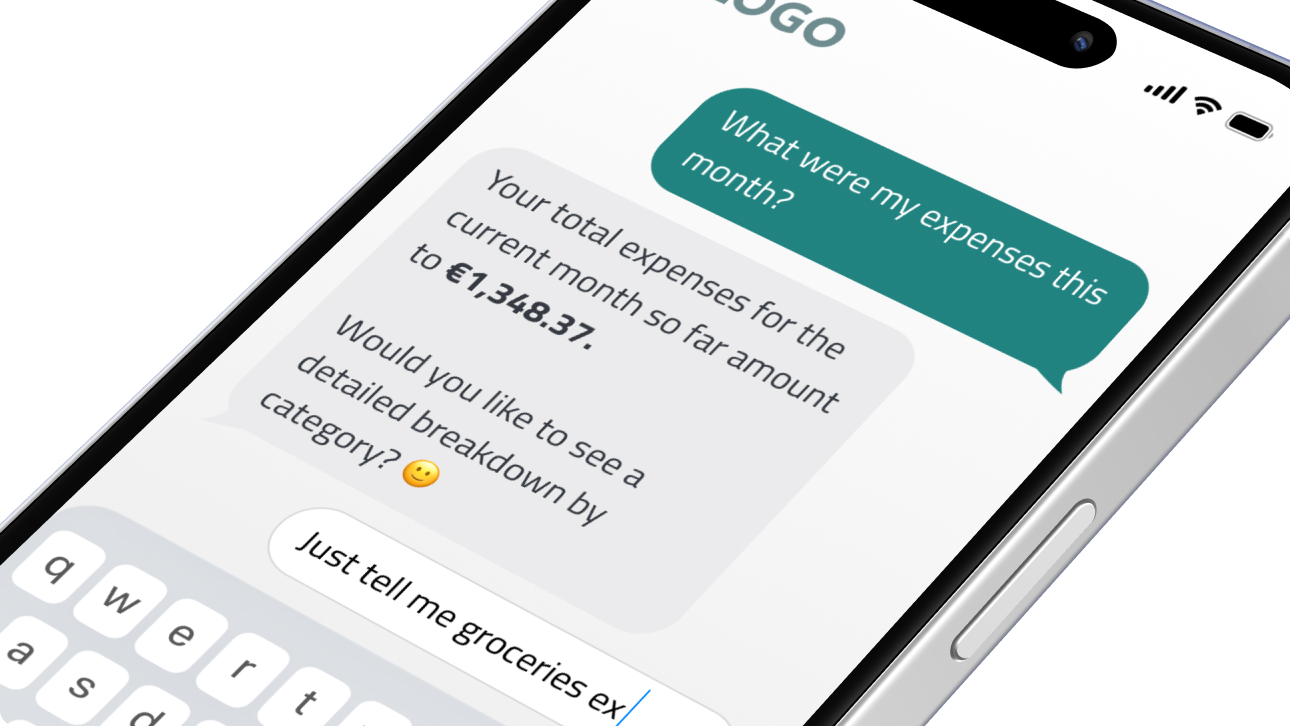

Learn moreMCP Server

LLM/Connect – Link to AI tools & chatbots: The MCP server allows BANKS/Connect and AI/Connect to be seamlessly integrated into chatbots or other LLM applications – regardless of the model used and whether it runs locally or is hosted externally.

Learn morePerformance features

The platform for Open Banking & Open Finance

BANKSapi sparks digital processes and business models:

-

Comprehensive Data Access

Access to hundreds of millions of accounts, securities accounts and financial products via a modern interface (RESTful & PSD2-compliant) -

Verified Market Relevance

Hundreds of thousands of consumers and companies from a wide range of industries use BANKSapi solutions -

High-Volume SEPA Payment Processing

BANKSapi reliably executes millions of euros in SEPA transactions on a regular basis – fast, secure, and regulated -

Robust Open Banking API since 2015

The REST API has been in productive use for over 10 years and is continuously being developed further -

Integrated Smart Data Analytics

Built-in Analytics Engine transforms raw banking data into actionable business intelligence – empowering risk scoring, transaction categorization, and financial behavior prediction -

Regulatory Compliance & Licensing

BANKSapi holds a PSD2 license as an account information service (AIS) and payment initiation service (PIS) issued by BaFin -

Accelerated Time-to-Market

Ready-to-deploy frontend modules for banking, consent, and data visualization enable instant go-to-market for digital finance products

Spotlight

NEW: LLM/Connect – Open Banking in the AI world

Only available with BANKSapi! With LLM/Connect, our MCP server, you can connect Open Banking features to your AI application. This allows you to create innovative use cases via chats, increase efficiency with agentic workflows, and much more!

NEW: Banking Widgets

Implement embedded banking at lightning speed - at surprisingly low cost! Financial distributors, pools, asset managers, insurers, etc. can upgrade existing applications with banking functions using our turnkey modules, which combine an intuitive user interface and secure API communication. Compatible, customizable & PSD2 compliant. Data & sales impulses on top!

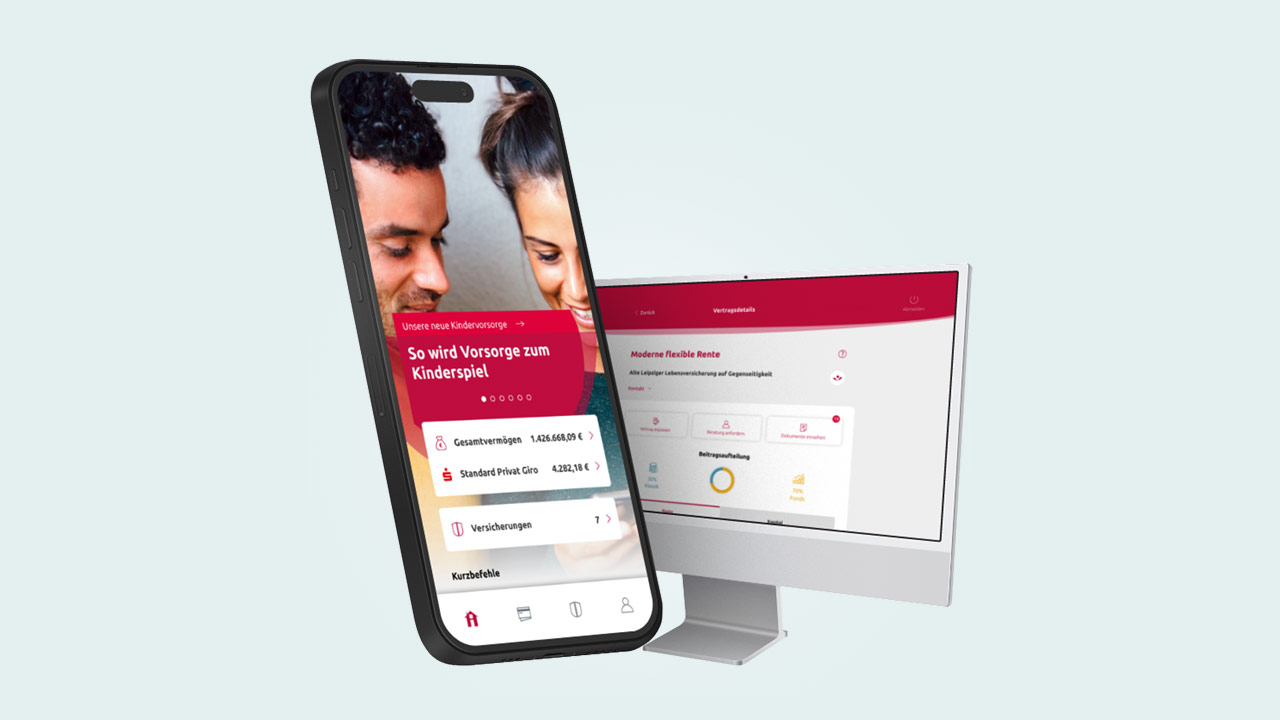

fin4u app & portal

The Alte Leipziger-Hallesche Group (ALH) commissioned BANKSapi with the fundamental revision of its customer portal “fin4u” as an app and web version. The core objectives of the new application were the perfect symbiosis of banking, insurance and pension provision as well as a modern and high-quality user interface in accordance with the ALH corporate identity guidelines, the renewal of the technological basis and a flexible integration capability of various internal and external data sources.