Frontend Solutions

HUMAN/Connect: Financial data and the insights based on it only generate value if they are made available to people. Our personal finance and business finance applications serve this purpose. We provide these ready-to-use according to your requirements – as a web portal and web application, as an app, or via a micro-frontend.

Request adviceOverview

Personal Finance Solutions – B2C

Cost-effective and modern applications for end customers: strengthen your everyday relevance and customer loyalty and increase your service quality and process efficiency, for example through self-service. Or record customer data via account analysis and use it to generate personalized product and optimization suggestions or streamline the consulting process.

Business Finance Solutions – B2B

Financial data can give your business a decisive boost: we implement your business finance application and help you to make use of the insights gained from account data and analyses. These can be, for example, sales cockpits or cash flow optimization tools that are tailored to your needs.

Micro Fontends - B2X

Banking functions or data visualizations can significantly increase the attractiveness and added value of your existing application. With just a few lines of code, you can integrate a payment route, data-based graphics and evaluations or a complete multibanking system into your existing landscape.

Customer portal

Applications that delight your customers

In addition to personal financial advice, customers expect digital processes and communication. With a modern portal, you can increase efficiency and improve service for your customers. Our flexible platform enables seamless integration into your process and system landscape. We use it to produce both apps and browser applications from a single source, even tailored to your individual requirements!

Request adviceFinancial Home

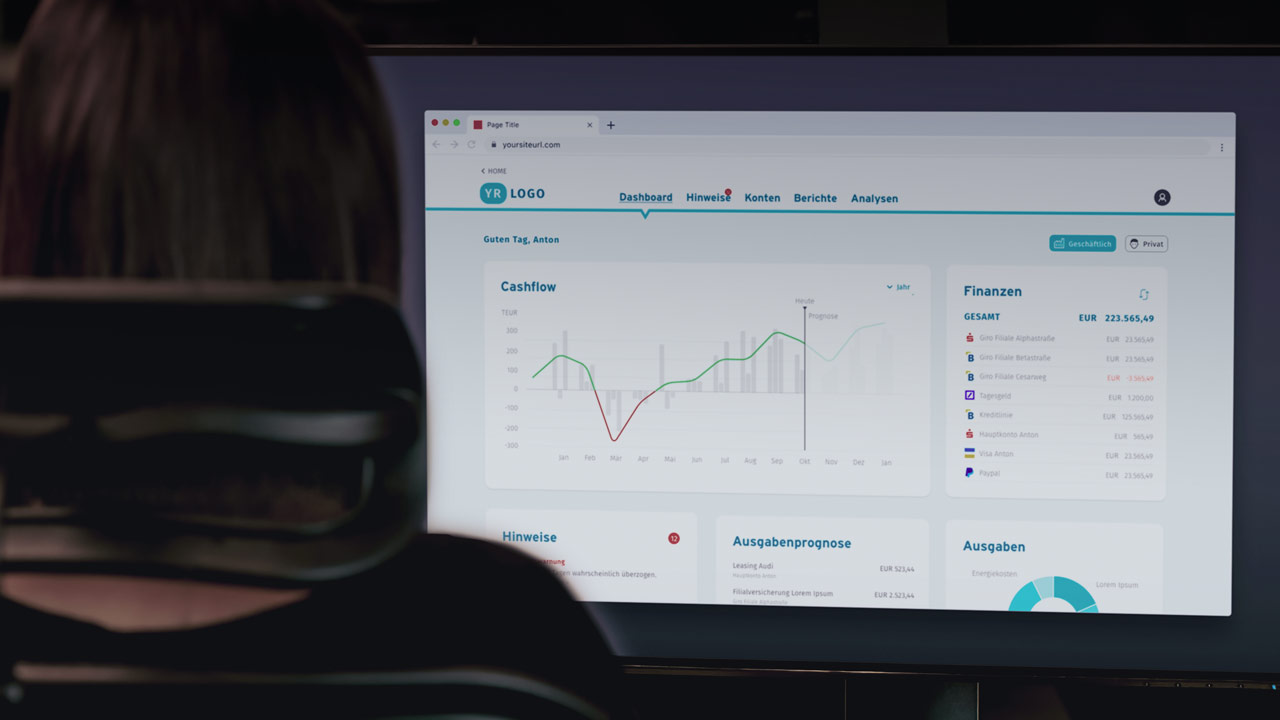

All finances in one place,

at a glance.

Bank accounts, securities accounts, building savings contracts, insurance policies and other investments can be monitored centrally in one place and the customer's financial situation can be displayed. By handling daily banking transactions, you increase your customer contact points many times over and generate sales trigger based on our data analyses. With a Financial Home, you position yourself as the first point of contact for all of your customers’ financial questions.

Request adviceAdvisor dashboard

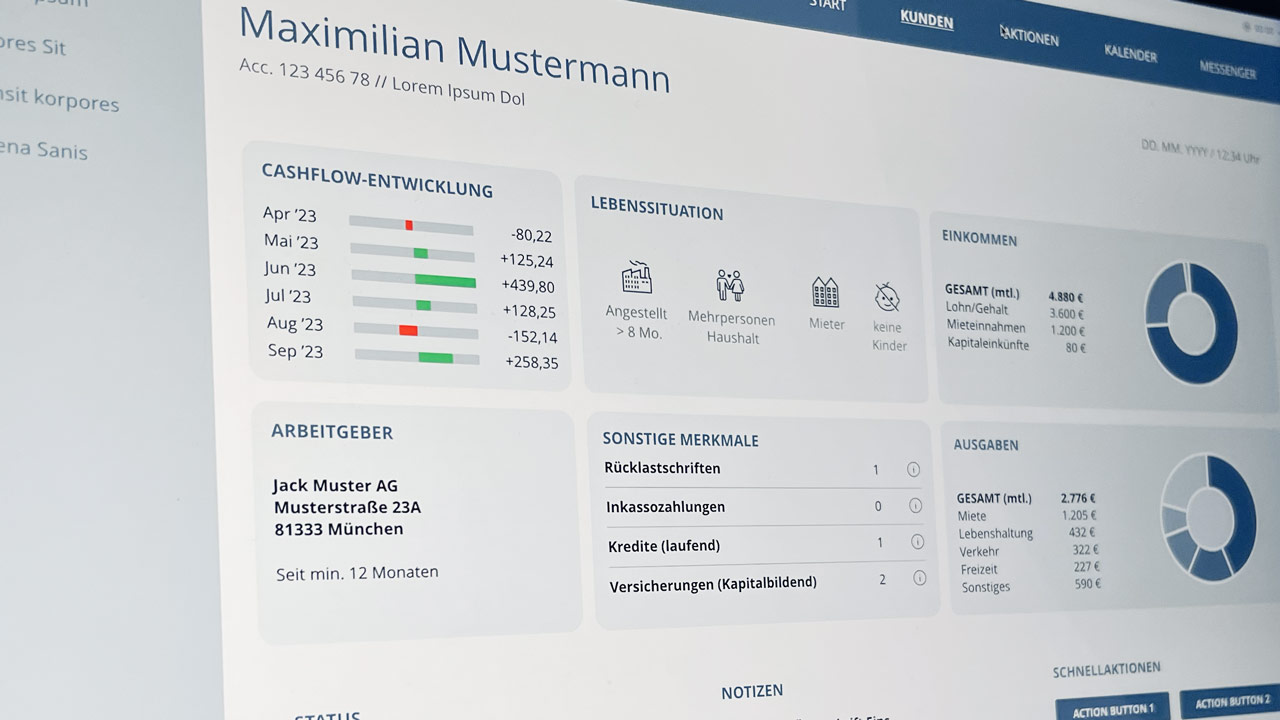

Customer overview with

integrated lead generator

In the work of a financial advisor, it is essential to keep an eye on the long-term development of the client's financial situation and to be on hand in the event of life-changing events. Our advisor dashboard gives you a constant overview of your clients' finances and informs you of important changes. This allows you to provide proactive advice and increase your sales success and turnover. This works best with the right customer app.

Request adviceCase study

The fin4u app from ALH

The Alte Leipziger-Hallesche Group (ALH) commissioned BANKSapi with the fundamental revision of its customer portal “fin4u” as an app and web version. The core objectives of the new application were the perfect symbiosis of banking, insurance and pension provision as well as a modern and high-quality user interface in accordance with the ALH corporate identity guidelines, the renewal of the technological basis and a flexible integration capability of various internal and external data sources.

Use cases

Digital budget book

Keep an eye on current income and expenditure, optimize spending habits with budgets, view contracts from recurring charges and receive tips on how to optimize your finances. With a digital budget book, you retain your customers and strengthen your position as a partner in financial matters.

Liquidity management

Forward-looking management of liquid assets and cash flow is an essential task for the commercial management of a company. Our analysis and forecasting tools help your business customers to keep an eye on their liquidity situation at all times and to optimize it. BANKSapi automatically retrieves the account data.

Digital insurance overview

We can automatically read existing insurance contracts from account transactions and prepare them in an overview for your customers. This saves your end customers time and effort and gives you the opportunity to make targeted cover proposals based on the available data or to provide more efficient advice based on this data.

Broker mandate

The broker mandate is an important prerequisite for providing your customers with comprehensive support in all insurance matters. Not every contract can or should be converted – but you still want to be remunerated for your advisory services. With a conversion-optimized process, you can easily add contracts to your portfolio and increase your sales.

Sales trigger

BANKSapi converts mere account turnover into knowledge and sales potential. This allows you to find out promptly about changes in life circumstances (e.g. job change, marriage or birth of a child) or other changes in the risk situation. You automatically receive a sales trigger. In this way, you remain a caring and attentive partner at your customers' side and increase your sales turnover.