EBICS for Corporate Customers & Enterprise Solutions

The Evolution of Financial Data Integration for Businesses: A Closer Look at EBICS and BANKSapi’s Unified Approach

By Felix Baaken, Co-CEO at BANKSapi Technology GmbH

For years, product managers building ERPs have struggled with integrating financial data from various sources even in times of Open Banking becoming more and more of a commodity. One key reason is EBICS, a crucial system for medium and large businesses. Its file-based design makes it tricky to fit into the same smooth workflows set up with other Open Banking interfaces. This meant that EBICS often had to be integrated separately from other bank systems, adding extra steps and learning for teams.

Understanding EBICS

EBICS, or Electronic Banking Internet Communication Standard, isn’t just another banking standard. Originating in the European banking landscape, it’s predominantly utilized by corporate clients across countries like Germany, France, and Switzerland. Its main function? To facilitate a secure exchange of payment and financial transaction data over the internet.

EBICS is specifically designed with the needs of businesses in mind. It offers:

- High-volume transaction capabilities: EBICS can handle substantial transaction volumes, making it a favorable choice for larger enterprises.

- Standardized electronic exchange: By adhering to EBICS, banks ensure a uniform way to transfer data, reducing inconsistencies and ensuring smoother communication between financial institutions.

- Robust security protocols: With data breaches posing significant risks, EBICS focuses on stringent security measures to protect transactional data.

BANKSapi: Bridging EBICS and Other Open Banking Interfaces

In the complex ecosystem of financial data, a unified approach becomes vital. This is where solutions like BANKSapi come into play.

BANKSapi offers an API that integrates both EBICS and non-EBICS (XS2A, FinTS, …) accounts. Such a unified approach has multiple advantages for product managers:

- Simplified Integration: Product managers can integrate a diverse range of bank accounts, whether they adhere to the EBICS standard or not, using a single API endpoint.

- Flexibility: By offering integration for EBICS and non-EBICS accounts, there’s greater flexibility in handling different types of banking interfaces.

- Consistency: Regardless of the underlying bank interface (EBICS or otherwise), the data retrieved maintains consistency in its structure, simplifying data parsing and usage.

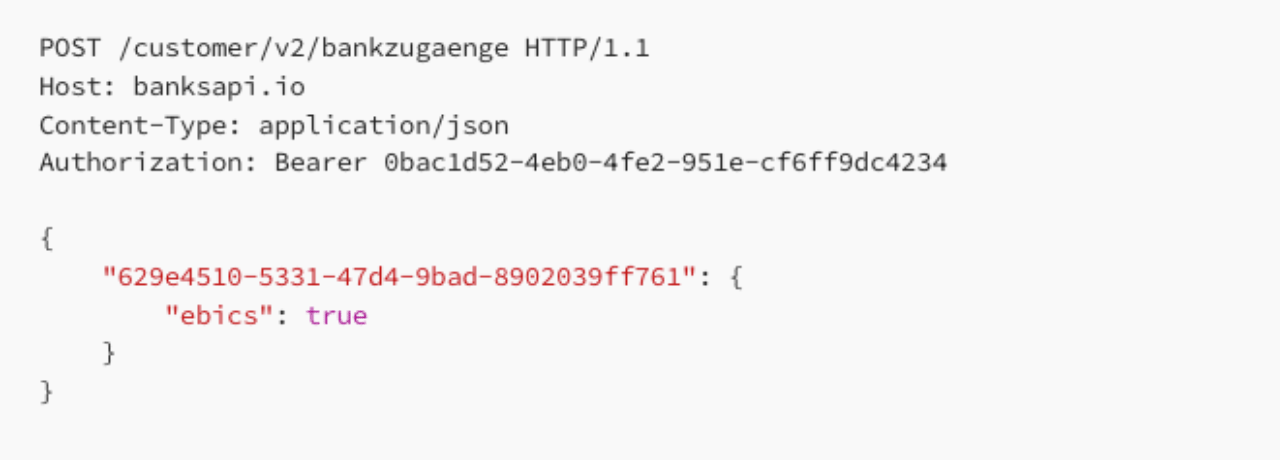

BANKSapi has completely abstracted its API for EBICS and non-EBICS bank accounts, the only difference being a little flag during the set-up:

Why This Matters for ERP Product Managers

As the demand for digital financial solutions grows, product managers need tools that allow them to innovate while adhering to standard protocols. By understanding and leveraging standards like EBICS and using unified APIs like BANKSapi, they can:

- Streamline Development: Reducing the number of integrations simplifies development cycles and speeds up time-to-market.

- Enhance Product Offerings: With a broader range of data access, product features can be enhanced, leading to richer user experiences.

- Maintain Security: Using standardized and well-maintained interfaces ensures that the highest security measures are always in place, protecting both the institution and its clients.

In Conclusion

While EBICS offers a robust framework tailored to business needs, BANKSapi’s unified approach ensures flexibility and ease of integration. For product managers, the evolving landscape of financial data access presents challenges but also unprecedented opportunities. By leveraging the right tools and understanding the nuances of protocols like EBICS, they can guide their teams to create innovative, secure, and efficient financial solutions for the modern age.

If you would like to learn more about how the integration process works, head over to our documentation.